Housing is already cooling in the U.S., according to July data that was reported last week. While major hurricanes with the potential to cause severe economic damage and a wave of mortgage defaults is not a new phenomenon, climate change is. In fiscal year 2024, it would limit military spending to 886 billion and nonmilitary. The more optimistic forecasts set the potential mortgage defaults between RMB 360 billion (USD 53 billion) and RMB 730 billion (USD 108 billion). Published on Topic: Regional Analysis Articles From New Zealand to the U.S., housing prices are likely to decline in many big countries, according to Goldman Sachs Research. The agreement includes spending caps for the next two years to set up the appropriations process.

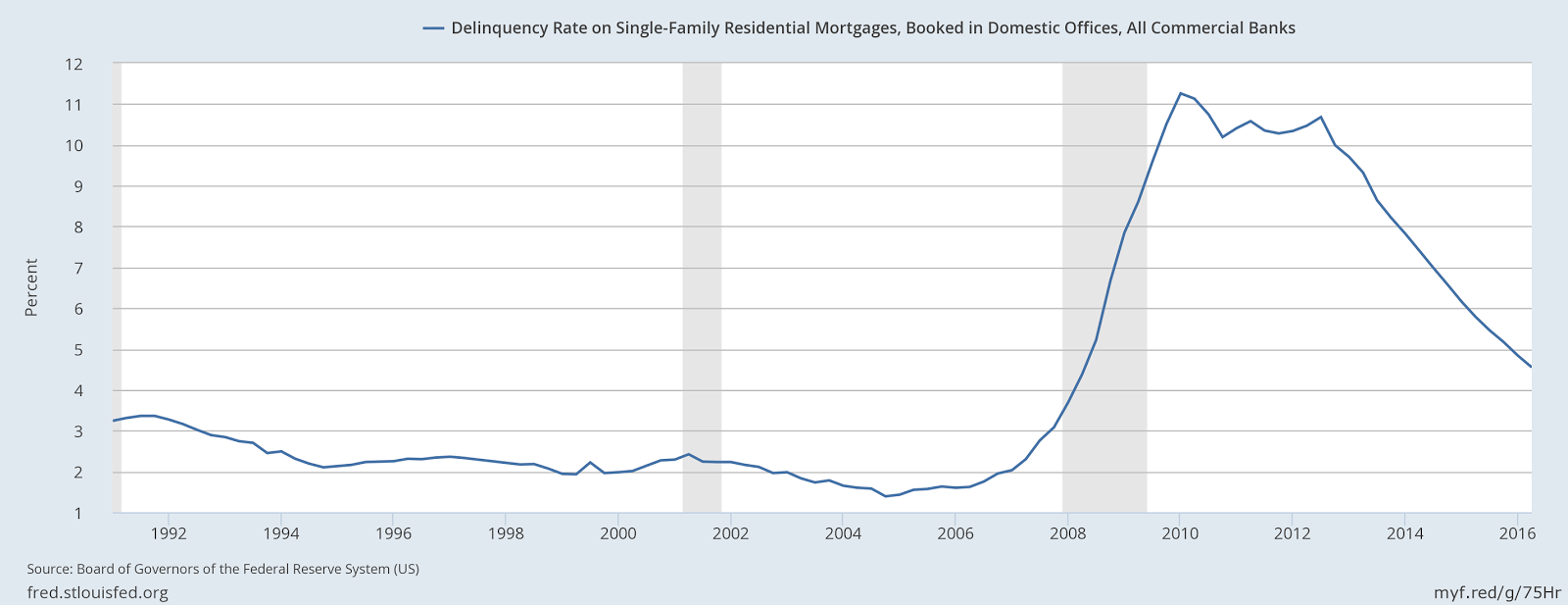

Some expect a massive default wave valued at hundreds of billions of USD, and a subprime-like crisis in China. In it, the analysts mention up to a fifth of deferred mortgages are at risk of default. Phew Wait what defaults RBC Capital Markets sent a research note to clients last week. Based on the banks’ announcements, the related non-performing assets account for just 0.001% to 0.01% of their mortgage loans (Mortgage is typically 20-40% of the toal loan portfolio). OctoCanada’s largest bank is prepared for the wave of mortgage defaults coming. (01-14-10) Foreclosures are likely to take front and center stage in the New Year for a number of interesting reasons. Covid-related lockdowns also cause the setback, to a certain extent.Ī number of Chinese banks responded with their own risk assessment, saying the default risk is “controllable”. The construction delays are mainly due to liquidity problems at the developers, and the lack of regulatory enforcement to protect the home buyer interest. In fact, during the second quarter of 2022, delinquencies fell to just 3.64 of outstanding loans, according to the Mortgage Bankers Associations National. Most of the private developers are in some kind of financial distress currently. The real estate developers include cash-strapped companies like Evergrande. With COVID-related income supplements and unemployment benefits now expired or reduced, we face a new wave of mortgage and rental delinquencies, many of which will come in the next few months. The number of cities and construction sites are growing, now estimated to affect more than 150 real estate projects. They are risking the down payments and their credit scores in a protest against the prolonged construction delays. Home buyers in two dozen Chinese cities (including Beijing and Shanghai) have stopped paying mortgages on their unfinished homes. This is a sequel to my earlier post on the growing phenomenon of residential mortgage defaults in China.

0 kommentar(er)

0 kommentar(er)